Trump’s bitcoin reserve disappoints market, weighs on crypto

08 Mar 2025

08 Mar 2025 Scroll down to discover the full story. Whether it inspires, informs, or moves you, we’d love to hear your thoughts.

March 7: Crypto Market Reacts to Strategic Bitcoin Reserve

The crypto industry saw renewed tension after former President Donald Trump signed a long-anticipated executive order establishing a strategic Bitcoin reserve. The order also included provisions for maintaining a stockpile of other digital assets.

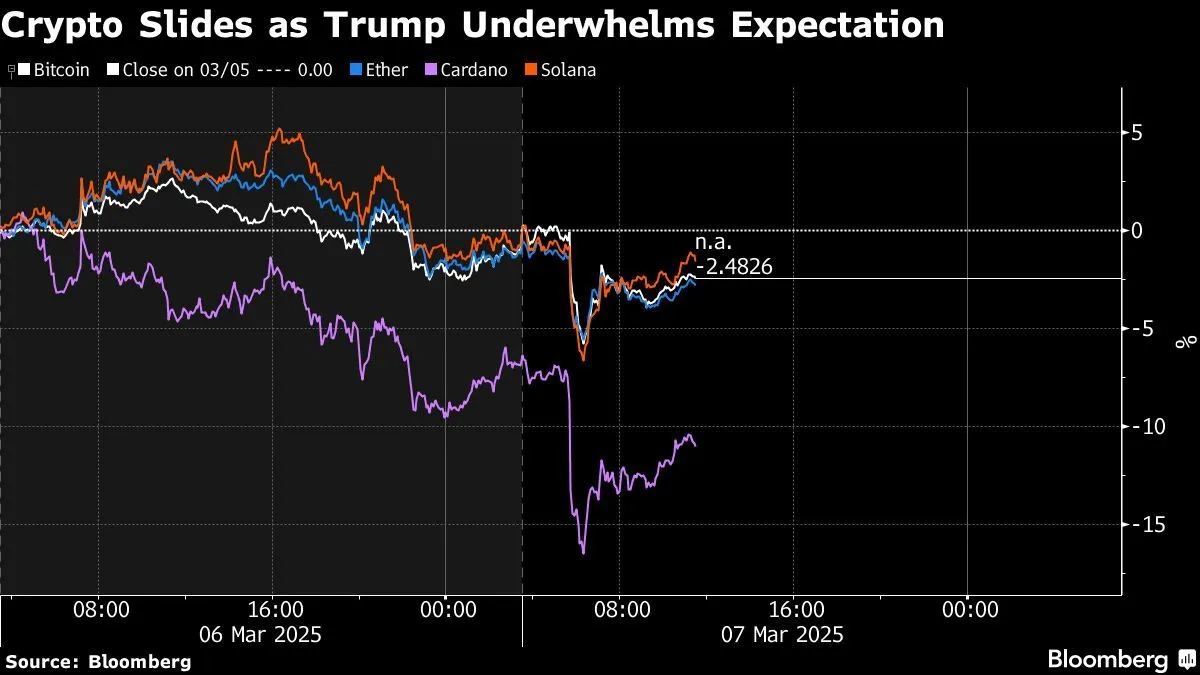

Despite initial enthusiasm from crypto executives, Bitcoin experienced a decline of up to 5.7%. However, the largest cryptocurrency later recovered most of its losses, stabilizing around US$89,410 (RM395,259) as of 8:10 AM in New York.

Other cryptocurrencies previously acknowledged by Trump—Ether (ETH), XRP, Cardano (ADA), and Solana (SOL)—also recorded price drops.

Market Response and Analyst Reactions

While many had hoped for a stronger bullish impact, analysts view the executive order as a long-term positive for crypto. According to a note from QCP Capital:

“While this wasn’t the outright bullish catalyst many were hoping for, it remains structurally positive for crypto. The prospect of random Silk Road BTC sales disrupting the market is now behind us, and the US government’s commitment to a long-term crypto strategy has been reaffirmed.”

Details of the Executive Order

The order, originally shared in a post on X (formerly Twitter) by White House crypto adviser David Sacks, outlined key details:

- The reserve will be funded with Bitcoin already owned by the U.S. government.

- New Bitcoin acquisitions must be budget-neutral and impose no additional costs on taxpayers.

- The government will not sell Bitcoin stored in the strategic reserve.

Crypto analysts noted that the lack of new Bitcoin purchases weighed on the market. Stefan von Haenisch, Director of OTC trading at Bitgo Inc, commented:

“Previously, investors were jumping into the market in anticipation of the government buying Bitcoin. With this latest development, these positions are being unwound.”

U.S. Crypto Holdings and Market Impact

The U.S. government currently holds approximately US$16.4 billion worth of Bitcoin and an additional US$400 million in other digital assets, largely obtained from asset forfeitures in civil and criminal cases.

Unlike Bitcoin, the executive order allows for the possible sale of other cryptocurrencies in the government’s stockpile, stating that the U.S. Treasury may determine strategies for “responsible stewardship, including potential sales.”

Crypto Leaders to Meet with Trump

As part of ongoing industry engagement, representatives from major crypto firms—including Coinbase Global Inc and Robinhood Markets Inc—are set to meet with Trump and Sacks at the White House.

According to Andrew O’Neill, Managing Director of Digital Assets at S&P Global Ratings:

“The significance of this executive order is mainly symbolic, as it marks the first time Bitcoin is formally recognized as a reserve asset of the United States government.”

Political Strategy and Crypto Sentiment

Trump’s campaign promise to establish a Bitcoin reserve was part of a broader strategy to attract crypto industry support, particularly from major donors. His commitment to firing former SEC Chairman Gary Gensler further fueled optimism in the market leading up to his inauguration.

However, sentiment in the crypto market has fluctuated in recent months, affected by:

- U.S. tariff policies impacting tech and finance sectors.

- A US$1.5 billion crypto hack.

- Significant outflows from digital asset ETFs.

Additionally, Trump’s surprise announcement on Truth Social that Solana, Cardano, and XRP would be included in the government’s digital asset plans initially sparked a market rally, though enthusiasm later waned.

Conclusion

The executive order marks a historic moment for cryptocurrency, formally recognizing Bitcoin as part of U.S. government reserves. While the immediate market reaction was mixed, analysts believe the long-term implications could be beneficial.

Source: Bloomberg, CNBC, CoinDesk

Don't forget to hit the like button if you found it helpful or inspiring! 💖 💬 We’d love to hear from you—share your thoughts, feedback, or questions in the comments below! Let's keep the conversation going.

No comments yet. Be the first to comment!